PIT withholding document are one of those document to help you prove it.So, what is PIT withholidng document and how to use it?

Please read this note and you can understand easily!

Nội dung bài viết

- 1 Overall procedure of PIT withholding

- 2 1. Input-Let’s collect the materials.

- 3 2. Prepare Withpolding docment andForm CTT25

- 4 3. Now you can use it to prove your Pesonal income tax

Overall procedure of PIT withholding

1. Input-Let’s collect the materials.

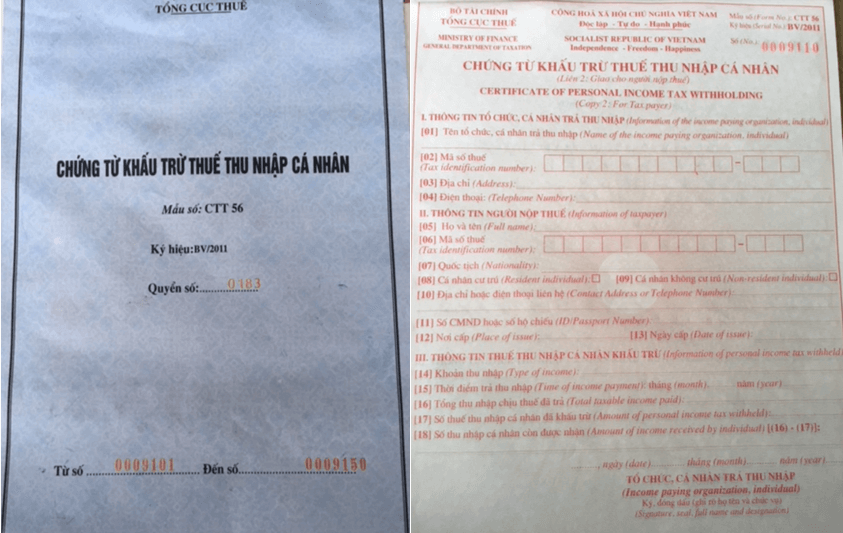

- Form of PIT withholding document

- Report of using PIT withholding document ( Form CTT25/AC – Circular 440/QĐ-TCT)

- Payroll

2. Prepare Withpolding docment andForm CTT25

2.1 Write PIT withholding document

2.1.1 When you must to write PIT witholding document?

According to the provisions at Point a, Clause 2, Article 25 of Circular 111/2013/TT-BTCstatus2, in case the Company, when paying salaries and wages to employees has withheld PIT, it must issue tax withholding documents by employee’s requirements. It’s not compulsary to issue tax withholding vouchers only applies to employees who authorize the Company to make PIT finalazation on behalf of the Company.

- For employee who are subject to PIT withholding at the rate 10%: The company can issue seperate voucher for each tax amount deduction or 1 voucher for all PIT tax deducted in the tax period

- For employee who are subject to PIT withholding at the progressive taxation: The company issue only 01 voucher in the tax period (point b, clause 2, Article 25 of Circular 111/2013/TT-BTC).

2.1.2 How to buy or print by self PIT withholding document?

Notes: The company can can buy PIT withholding document from Tax department or register to print byself. For almost SMEs, they applied buy PIT withholding document case. Therefore, in this post, we only research about buy PIT withholding document.

2.1.2.1 Documents

- An application form for a PIT withholding voucher, form 07/CTKT-TNCN, enclosed with Circular 92/2015/TT-BTC. (1 copy)

- Business registration license of the enterprise (notarized photocopy (1 copy))

- Introduction letter of the enterprise (01 copy)

- A photocopy of the people’s identity card of the person named on the introduction, enclosed with the original ID card for comparison

2.1.2.2 Submit to tax and get PIT withholding voucher

Submit above documents directly to the Tax authority and get PIT withholding voucher. Form:

2.1.3 How to write PIT withholding document?

2.2 PIT withholding document using report (Form CTT25/AC according Decision No. 440/QĐ-TCT)

From the day The company use PIT withholding document, quarterly, the company must to submit report on the use of PIT withholding document.

Deadline: 30th day of the next month from the end of previous quarter.

2.2.1 Form CTT25/AC:

2.2.2. How to submit Form CTT25/AC

Print 02 copies, sign and stamp. Then, The company submit offline in the Tax Department

Example:

3. Now you can use it to prove your Pesonal income tax

After that, employee can use PIT withholding document to income tax and PIT tax deducted in the tax period to make PIT finalazation by themself.

Nhân viên tư vấn của Manabox Việt Nam.

Với mong muốn chia sẻ kiến thức tới mọi người, chúng tôi sẽ cung cấp thông tin cập nhật nhất tới độc giả quan tâm.